If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan.Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.Want to Make Irregular Payments? Do You Need More Advanced Calculation Options? We also offer three other options you can consider for other additional payment scenarios. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. In addition, you will get the loan paid off 2 Years 1 Months sooner than if you paid only your regular monthly payment. If you make the initial extra payment amount you entered and pay just $50.00 more each month, you will pay only $380,277.66 toward your home. By the time the 30 year time period is complete, you will have paid $391,682.75 for your home.

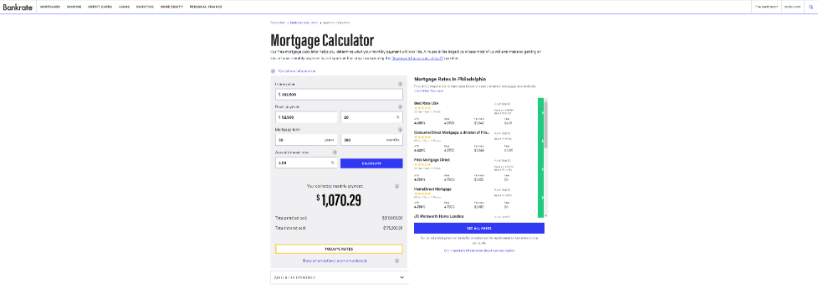

If you take out a 30 year loan for $250000.00 with a 3.250% interest rate, for example, your monthly payment (interest and principal only) will be $1,088.02.

When it comes to a home mortgage loan, you can actually pay off the loan much more quickly and save a great deal of money by simply paying a little extra each month. Your Results in Plain English ( Switch to Financial Analysis)

0 kommentar(er)

0 kommentar(er)